Quick Briefing

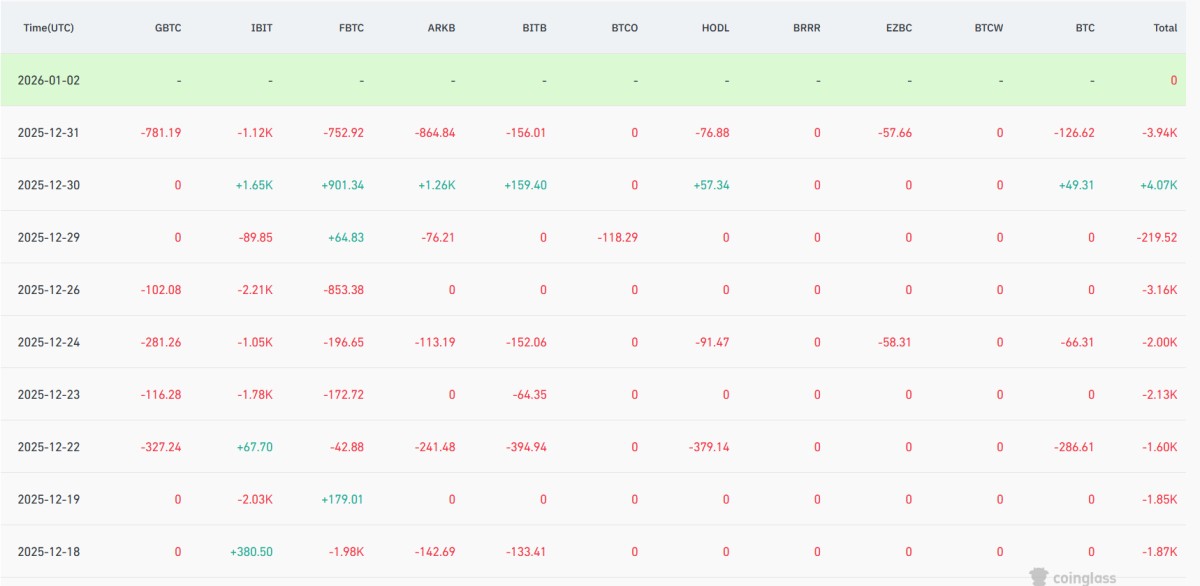

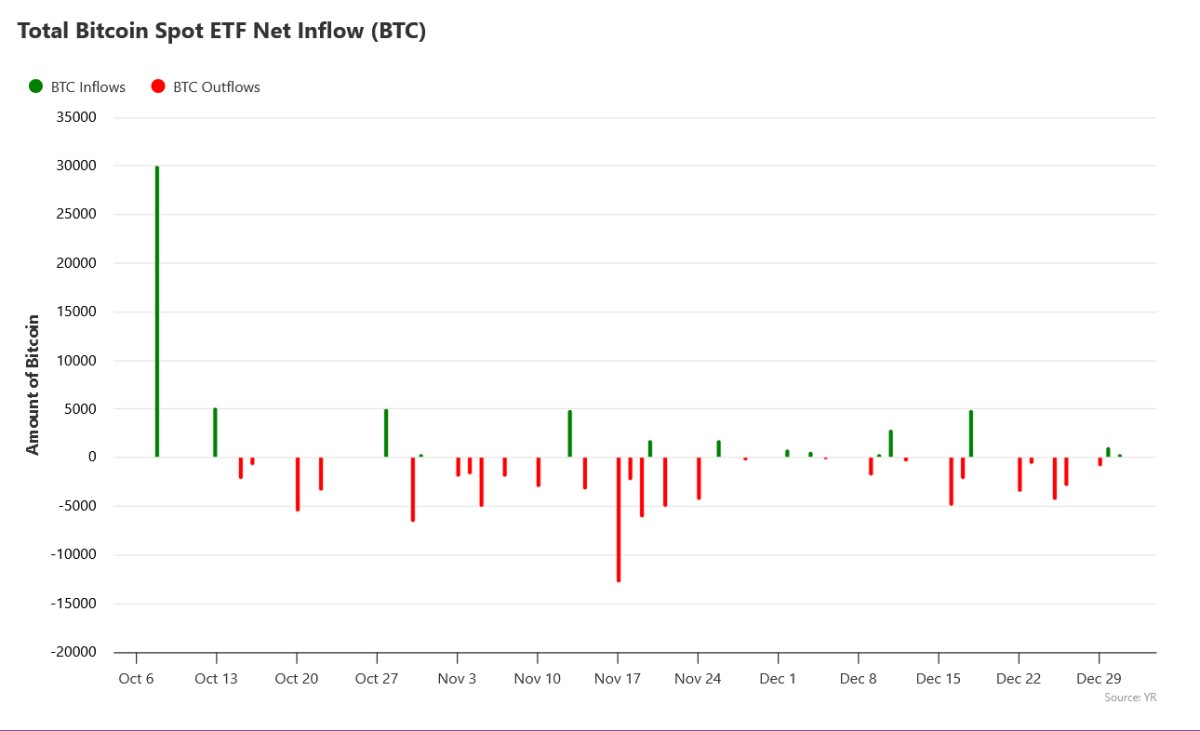

- The big picture is that Bitcoin ETFs have seen a quiet but steady wave of selling from institutional investors who are deliberately reducing their crypto exposure, not panicking.

- This matters because these persistent ETF sales inject continuous supply into the market, acting like a constant headwind that makes it tough for Bitcoin to sustain rallies and break out of its current range.

- So, what's the catch? Bitcoin's price is likely to stay stuck in a range, with advances being short-lived, until we see these ETF outflows slow down significantly or, even better, start to reverse into net inflows. That's the real game changer.

Because spot ETFs must sell underlying Bitcoin to meet redemptions, these flows translated directly into additional supply entering the market. The effect was visible in price behavior. Bitcoin did not experience a sharp breakdown. Instead, it traded within a broad range, struggled to sustain breakouts, and consistently faded after short-lived rallies. This is a typical response when continuous supply meets stable but cautious demand.