Quick Briefing

- Here's the scoop: Even though the U.S. Senate delayed key crypto legislation – which usually sparks panic – Bitcoin's price barely flinched after its new ETFs launched. We saw a brief dip, but it quickly settled, showing remarkable resilience instead of a sell-off.

- Why this matters: This isn't weakness; it's a sign of a really strong market. People aren't bailing; they're just trimming leverage and adjusting their positions. The big picture is that Bitcoin's fundamental structure remains robust, absorbing bad news without unraveling.

- But don't get too comfy: While Bitcoin shrugged this off, persistent regulatory delays or a complete stall in policy progress could still introduce future uncertainty. We gotta keep an eye on those Senate discussions, because sustained political inaction might eventually test the market's patience.

On the IBIT 1-hour chart, price opened lower and briefly dipped into the 53.6–53.7 zone. What stands out is what didn’t happen next. There was no continuation sell-off, no acceleration lower, and no CME gap distortion. Price stayed compressed between roughly 53.6 and 53.9, rotating instead of trending. That range acted like a holding area, not a trapdoor.

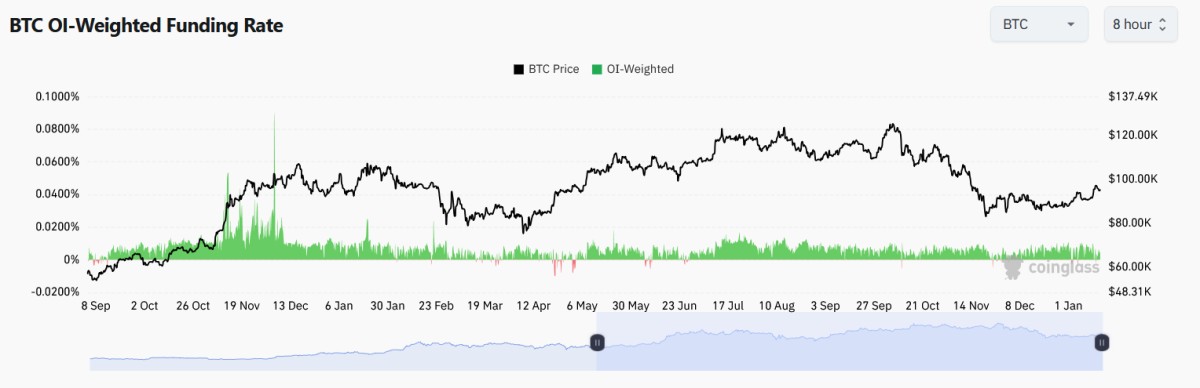

Open interest eased, but it didn’t collapse. There were no liquidation spikes and no disorderly drops. This looks like leverage being trimmed, not flushed. When leverage resets quietly and price holds, it usually means positioning is adjusting, not reversing.

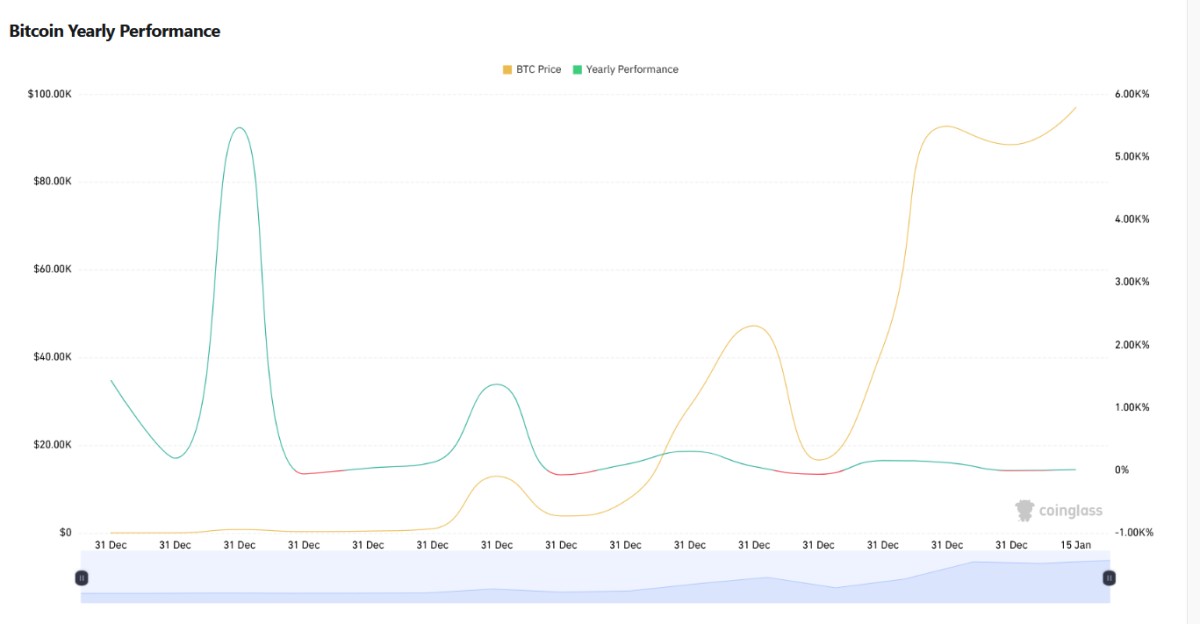

The yearly performance data adds another layer. Bitcoin is still up roughly 60–70% year over year, depending on the exact reference point. More importantly, recent pullbacks have formed well above prior consolidation zones. Even after this week’s volatility, price remains far above last year’s mid-range levels. That tells you the broader structure hasn’t changed.

About Meow Alert

Crypto analyst and researcher with 13k+ followers on Binance Square. Focused on on-chain data and market structure.