Quick Briefing

- Here's the scoop: Michael Saylor's still shouting from the rooftops that Bitcoin is a structural inflation hedge – basically, essential 'money medicine' for eroding fiat. But the report says, ironically, institutional money isn't quite acting on that conviction in the short term.

- Why this matters? This creates a clear 'gap' where the long-term bullish narrative (Bitcoin as a store of value) is solid, but big players are being super cautious with their near-term capital, signaling we're in a holding pattern, not a crisis.

- The key thing to watch is those consistent institutional ETF outflows; they mean big money is reducing risk, not piling in. So, don't expect a sudden breakout until a major macro catalyst forces their hand and aligns short-term action with Bitcoin's core narrative.

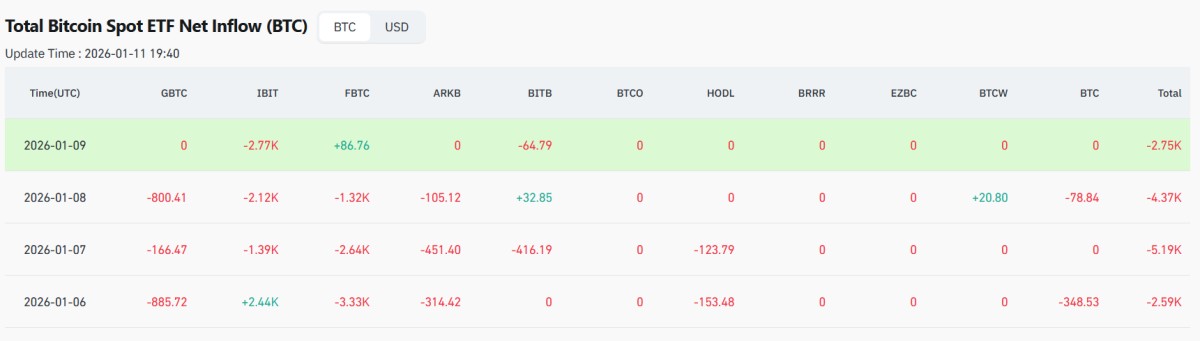

Spot Bitcoin ETF Net Flows (BTC):

- January 6: −2.59K BTC

- January 7: −5.19K BTC

- January 8: −4.37K BTC

- January 9: −2.75K BTC

Charts & Data:

About Meow Alert

Crypto analyst and researcher with 13k+ followers on Binance Square. Focused on on-chain data and market structure.